Business Insurance in and around Laredo

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Kevin Romo. Kevin Romo relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

If you're looking for a business policy that can help cover computers, buildings you own, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

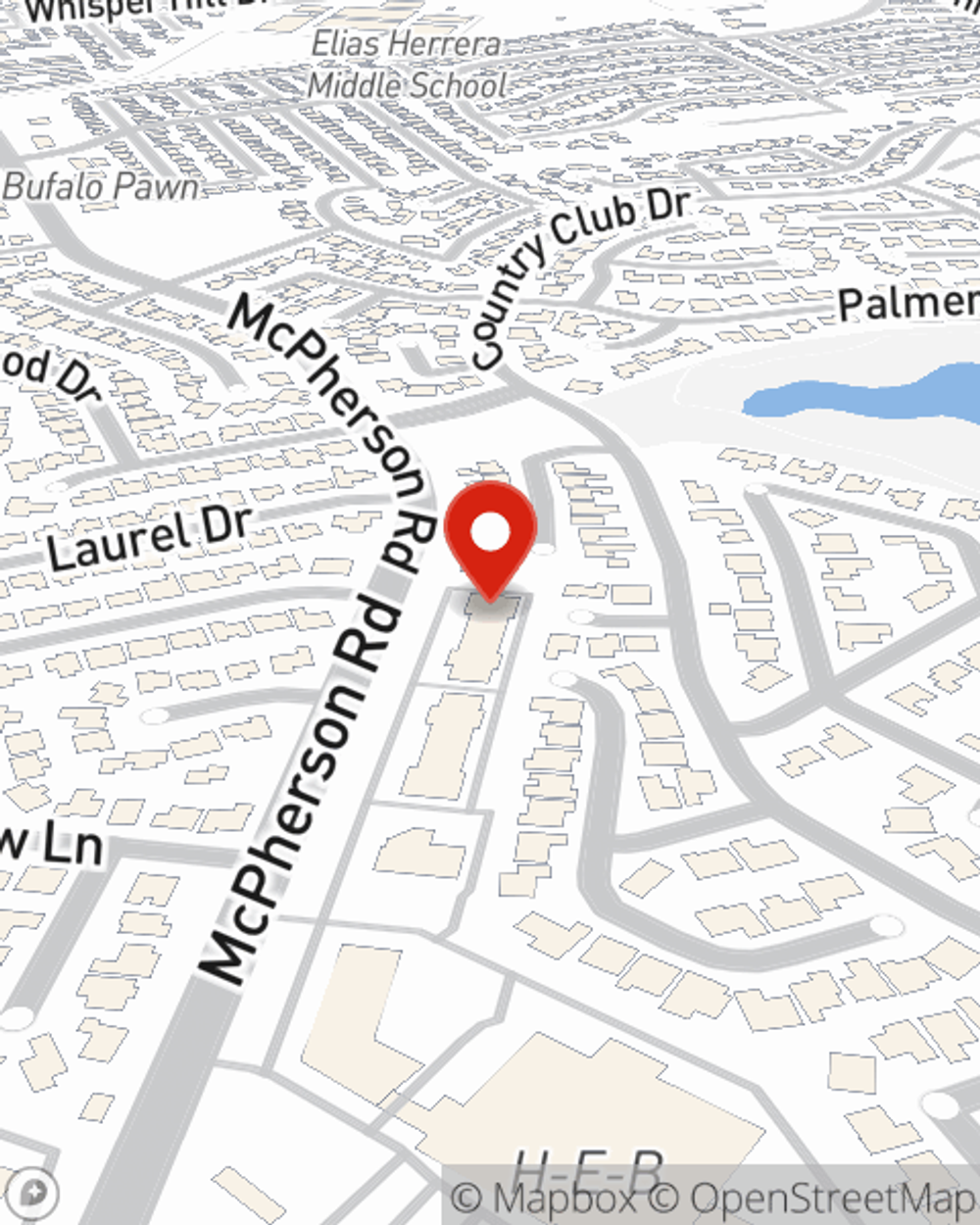

Get in touch with State Farm agent Kevin Romo today to explore how one of the leaders in small business insurance can ease your worries about the future here in Laredo, TX.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Kevin Romo

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.